paying indiana state taxes late

Apr 18 2022. Many taxpayers in Indiana say theyve waited well beyond the three weeks it should take to their money.

Don T Toss These 2 Important Stimulus And Child Tax Credit Letters From The Irs

Also a clause in state law could force those in charge to take notice.

. Find Indiana tax forms. Send in a payment by the due date with a check or money. Trusted Reliable Experts.

Send in a payment by the due date with a check or money order. Know when I will receive my tax refund. Apr 11 2022 1003 AM EDT.

Theres new information on how one agency is wasting thousands of your tax dollars by failing to pay utility bills on time. The penalty for filing late is normally five percent of the unpaid taxes for each month or part of a month that a tax return is late. Take the renters deduction.

Quickly End IRS State Tax Problems. This site contains confidential and personally identifiable information. Click on Make Payment or Establish Payment Plan in the navigation bar.

Take the renters deduction. Failure to file corporate or partnership tax return reporting zero tax liability. Youll be redirected to InTime or the Indiana Taxpayer Information Management Engine.

Paying indiana state taxes late Tuesday April 5 2022 Edit If you dont have a bill or dont know the amount due you can get assistance by calling the Indiana Department of Revenue at 317. Indiana state income tax forms need to be submitted by april 15th to not be considered late. Make a payment online with.

Penalty for Filing Late Taxes in Indiana Required Filers. You must file an income tax return for Indiana if you live in the state year round and the total. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

INDIANAPOLIS If youre still waiting for this years tax refund you are not alone. Know when I will receive my tax refund. This service uses a paperless check and may be used to pay the tax due with your Indiana individual income tax return as well as any billings issued by the Indiana Department of.

Affordable Reliable Services. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill.

There are several ways you can pay your Indiana state taxes. Analysis Comes With No Obligation. Expand All Collapse All.

Have more time to file my taxes and I think I will owe the Department. The penalty for failure to file by the due date is 10 per day that the return is past due up to 250. Up to 25 cash back Indiana property taxes are due twice a year in May and November.

Scroll down and navigate to Make a. Pay my tax bill in installments. Apr 13 2022 1014 AM EDT.

Take Advantage of Fresh Start Options. The penalty for filing late is normally five percent of the unpaid taxes for each month or part of a month that a tax return is late. Those individuals will have an unpaid tax liability that is 1000 or more in any of the following tax types.

INDIANAPOLIS Hoosiers expecting a little extra in their tax refund will have to wait before cashing in. A property is eligible to be sold at a tax sale when the prior years spring installment of property taxes remains. Tax Relief up to 96 See if You Qualify For Free.

Indiana state income tax forms need to be. Find Indiana tax forms. Certain individuals are required to make estimated income tax payments.

Ad Get Your Free Tax Review. Indiana state agencies late payments are routine practice. The indiana use tax rate is 7 the same as the regular indiana sales tax.

Ad We Can Solve Any Tax Problem. In addition a separate 10. Claim a gambling loss on my Indiana return.

If you dont have a bill or dont know the amount due you can get assistance by calling the Indiana Department of Revenue at 317-232-2165. Penalty for Filing Late Taxes in Indiana Required Filers. Indiana taxpayers will start receiving their respective 125 one-time automatic refunds starting next month.

The penalty for filing late is normally five percent of the unpaid taxes for each month or part of a month that a tax return is late. Heres when Indianas 125 automatic taxpayer refund will hit your account. Interest is paid on.

INDIANAPOLIS The Indiana Department of Revenue has an important message for Hoosiers who havent filed their 2021 income taxes yet todays the deadline to file. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. That penalty starts accruing the day after the tax filing due.

When Can I Sue A Tax Accountant Findlaw

/cloudfront-us-east-1.images.arcpublishing.com/gray/L6QOIUO7NRFJ3ENZ4A52GTLCKU.bmp)

Don T Toss These 2 Important Stimulus And Child Tax Credit Letters From The Irs

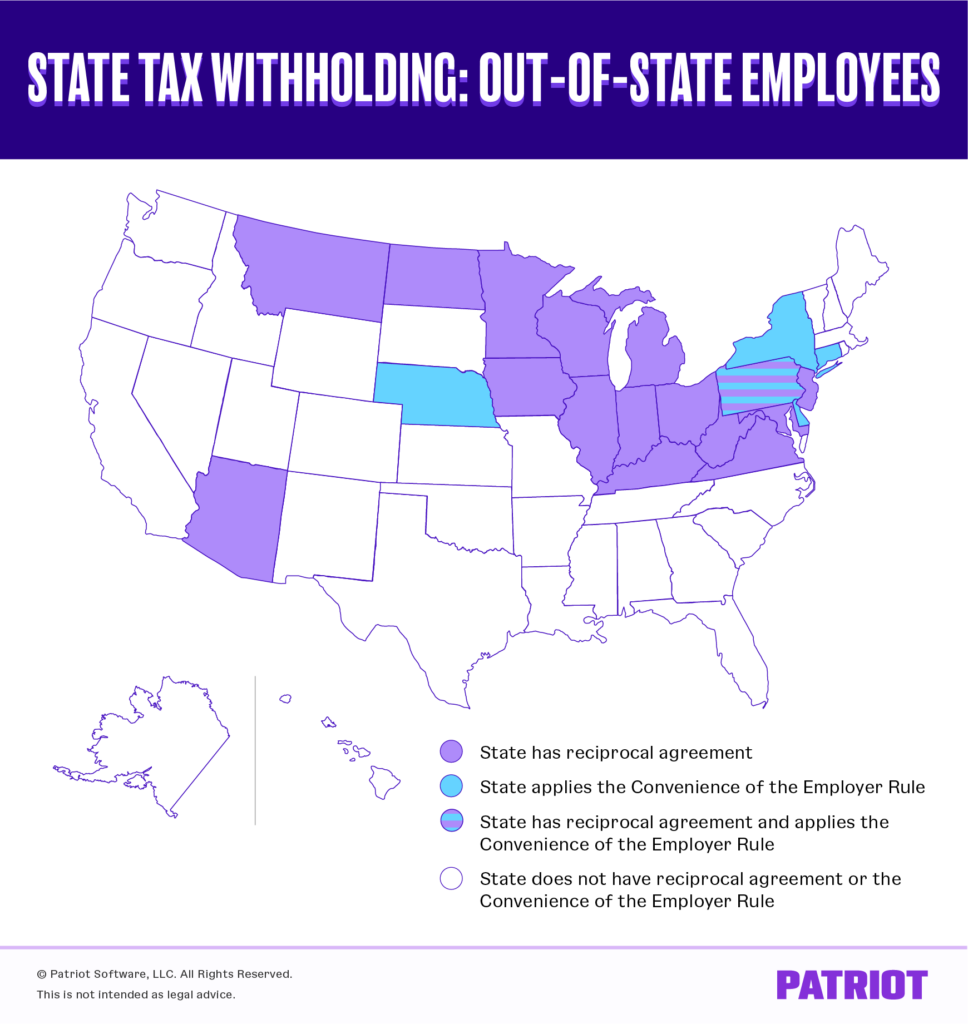

State Tax Withholding For Remote Employees

Saving For College Here S The Plan Tax Guide 1040 Com File Your Taxes Online

New Jersey Sales Tax Small Business Guide Truic

2022 Federal State Payroll Tax Rates For Employers

Considerations For Filing Composite Tax Returns

Filing A Michigan State Tax Return Things To Know Credit Karma

File Wi Taxes Amended Tax Returns E File Com

Income General Information Department Of Taxation

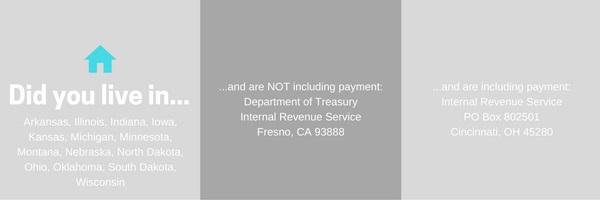

Irs Address To File A Late Tax Return Priortax

Income General Information Department Of Taxation

Irs Tax Extension What Is The Impact Of An Extension On Your Refunds Marca

Where S My Refund Indiana H R Block

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040